Last Friday, Daily Monitor published a leaked list of 65 firms it said are financially distressed and may be bailed out by government as a result. The companies owe Shs1.3 trillion to different banks, which debts the government is apparently considering to help them settle.

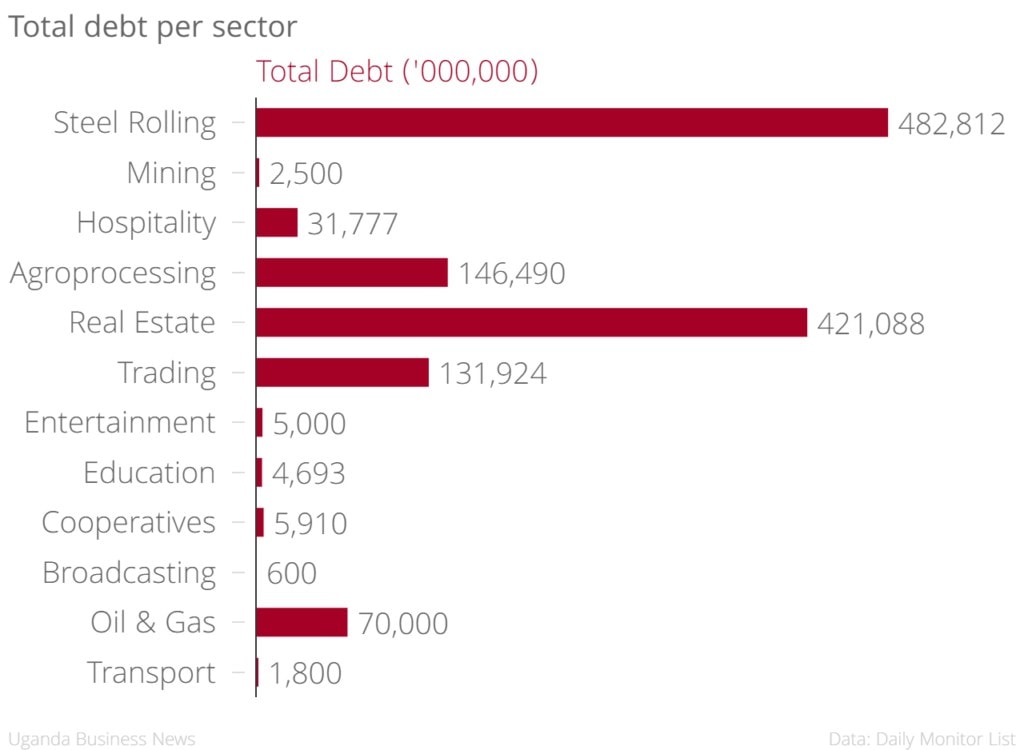

The two most indebted firms on the list, which we are republishing, owe Shs201 billion each, while the third most indebted has outstanding loans of Shs120 billion. There are five steel firms on the list, which owe the largest amount of combined loans: Shs483 billion. The real estate sector, with 13 firms, is second with total debts of Shs421 billion.

These huge debts are indicative of the rise in non-performing loans in the banking sector during last calendar year. The ratio of non-performing loans to total gross loans rose to 5.3% in 2015 from 4.1% the previous year, according to data from Bank of Uganda. This translates to Shs573.4 billion in total non-performing loans in 2015, compared to Shs389.6 billion in 2014.

Some of the largest commercial banks reported record losses and reduced profitability because they were forced to increase their allowance for bad debts to cover non-performing loans. One of these banks, classified as a “domestic systemically important bank” by the central bank, had a “significant exposure to one borrower.”

We do not know which one- if any- of the firms on the list is responsible for the bank’s troubles. But the government is not denying the authenticity of the list, or if indeed it is considering bailing out the firms. The finance minister indicated that the issue is under discussion, according to Daily Monitor.

President Museveni said government would provide support to companies with large debt obligations in the State of the Nation Address. He blamed the debts on high commercial lending rates, which stood at an average of 24.6% at the end of last year compared to 20.7% in 2014. Interestingly, he singled out distressed companies in the oil sector; oil and gas firms owe Shs70 billion to banks, according to the leaked list.

Not everyone in government is on board with the idea of bailing out the firms. Apparently the central bank and technocrats from the finance ministry think a bailout ignores the more urgent economic issues that should be addressed.

And maybe some just don’t buy the idea of using taxes to rescue nightclubs, hotels, and for-profit schools.