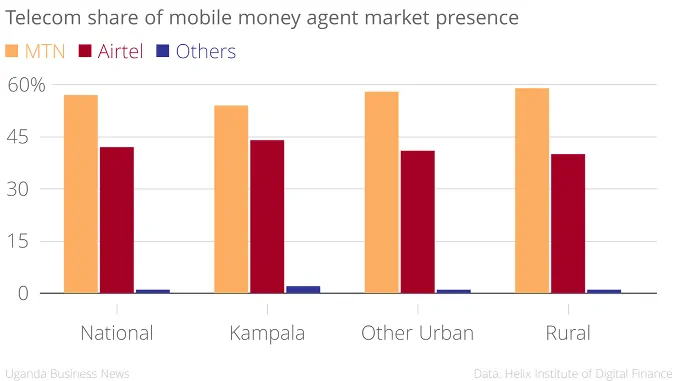

The mobile money sector is dominated by two telecoms, MTN Uganda and Airtel, who together account for 99% of mobile money agent market presence, according to a new report. The market leader is MTN with 57%, followed by Airtel with 42%. Other telecoms account for the remaining 1%.

The findings are in a survey report published on Wednesday by Financial Sector Deepening Uganda and The Helix Institute of Digital Finance. The report surveyed 2,288 mobile money agents across the country last year; 712 of these were in Kampala, 884 in other urban areas, and 692 in rural areas.

Agent market presence, according to the report, is “the proportion of cash-in/cash out agents by provider.” The figures “are provided on a till basis, therefore if an agent serves three providers the agency is counted three times.”

MTN leads across all geographical areas. Its market presence is more pronounced in rural areas where 59% of agents serve the network, and 40% serve Airtel. In other urban areas the difference is 17%; 58% for MTN and 41% for Airtel. In both areas, other networks account for only 1% of total transactions.

The sector is more competitive in Kampala. Here, the gap in market presence between MTN and Airtel drops to 10%. MTN’s share is 54%, Airtel’s is 44%, while other telecoms manage 2%.

MTN has the biggest share of mobile subscriptions in Uganda at 52.7%, according to recently released half year results. It lost a quarter of its mobile money customers last year after disconnecting 3.7 million subscribers who did not fully comply with regulatory registration requirements.

| Related: Data adds to MTN Uganda profit as voice calls slow |

The good news for Airtel is that it has actually increased its market presence since 2013 when the survey was last carried out. At the time, Airtel and Warid – which merged in April 2013 – had a combined market share of 31%. MTN’s share was 63%, while other providers accounted for 5% of total market presence.

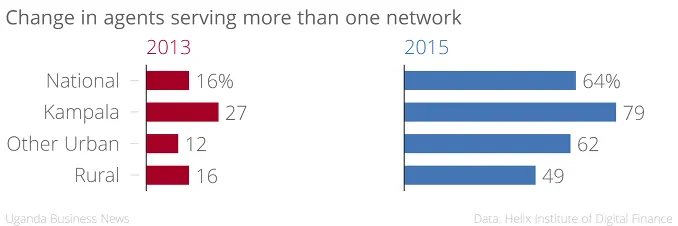

Airtel’s growth spurt is partly a result of the company prioritising mobile money during the tenure of its previous chief executive officer, Tom Gutjahr. But changes in regulation have also helped. Bank of Uganda’s Mobile Money Guidelines, which went into force in October 2013, prohibited exclusivity agreements between mobile money service providers and agents. As a result, the proportion of non-exclusive agents has increased by 48% – from just 16% in 2013 to 64% in 2015.

Kampala, especially, has had the highest increase in agents serving more than one network. The report puts them at 79% last year versus 27% in 2013, a 52% rise. Rural areas have registered the least change with an increase of just 33%.

The more profitable agents are those who serve more than one network, the survey found. Non-exclusive agents make close to double in median profit – $90 per month (Shs303,843) -what exclusive agents make ($47, or Shs158,680). Uganda’s agents are also the most profitable in the three East African countries covered by the survey, earning a higher median profit on a purchasing power parity basis ($188) than agents in Tanzania ($175) and Kenya ($154). At current dollar prices, however, they earn less than Kenyan agents ($75 to Kenya’s $77) but more than agents in Tanzania ($70).

East Africa has the highest levels of dedicated agents among the countries surveyed by Helix (the others are Bangladesh, India, Pakistan, Senegal, and Zambia). A dedicated agent is one who conducts solely mobile money services or solely mobile money and airtime distribution from the shop. Uganda leads the region with 63% of dedicated agents, Tanzania follows with 43%, and Kenya has 36%. In Uganda, rural areas have fewer less dedicated agents (57%) -74% of non-dedicated agents in rural areas run “drug shops.”

Uganda’s high levels of exclusivity, according to Helix, “are encouraging as they point to a strong value proposition for agents: one that allows them to stay dedicated to the mobile money business.” Even then, it notes that telecoms “will want to distinguish themselves and secure an agent’s loyalty by offering compelling propositions,” due to the competition in the market.

This seems counterintuitive, given that 99% of all agents are serving just two providers. And with exclusivity agreements prohibited by the central bank, it is unlikely that there will be a large shift away to serving only one provider. The likelier scenario would be agents spreading out to serve telecoms popular with customers, which puts the focus on first line strategies to increase mobile subscriptions.

Uganda has seven telecoms offering mobile money services; MTN, Airtel, Uganda Telecom, Africell, MCash, EzeeMoney, and Smart Telecom (which launched its mobile money service this year). The number of mobile money telephone lines increased by 12.2% in 2015 from 18.8 million to 21.1 million, according to Bank of Uganda. The total value of transactions was Shs32,500 billion versus Shs24,100 billion in 2014. Total transactions increased by 39.8% to 693.6 million from 496.3 million the previous year.