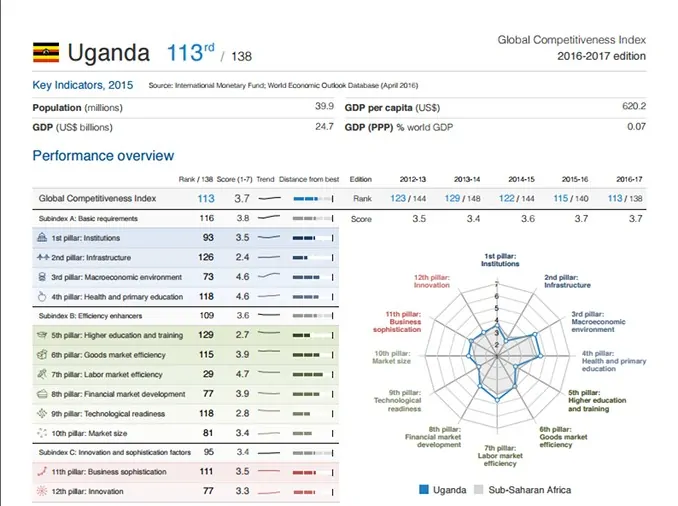

Uganda has moved up two places in the World Economic Forum’s Global Competitiveness Report rankings, its best scores coming in the labour market efficiency, macroeconomic environment, and health and primary education pillars. Its poorest scores were in the infrastructure, higher education and training, and technological readiness pillars.

The annual report surveys business leaders for their opinion on the indicators it uses to compile the rankings, and also relies on economic statistics. The executives are asked to evaluate an economy on, among other criteria, the most problematic factors for doing business, infrastructure, financial environment, governance, and risks. In Uganda 95 executives were surveyed this year.

Uganda is at No.113 out of the 138 countries included in the survey. The top ranked country is Switzerland, followed by Singapore, and the United States of America. In Africa, the most competitive countries are Mauritius at No.45, South Africa at 47, Rwanda at 52, and Botswana at 64. Kenya is ranked No.96, Ethiopia is 109, while Tanzania and Burundi are ranked below Uganda at 116 and 135.

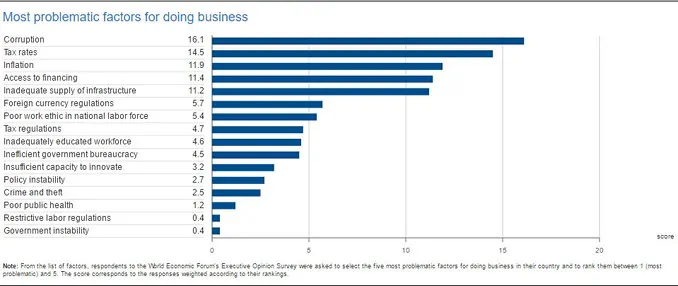

The most problematic factors for doing business in Uganda, according to the executives sampled, are corruption, tax rates, inflation, access to financing, and inadequate supply of infrastructure.

In Rwanda, the third highest ranked African country and most competitive in East Africa, access to financing, an inadequately educated workforce, and tax rates are the most problematic factors. Corruption features, but ranks very lowly among executive’s concerns.

This year’s report finds that “declining openness is threatening growth and prosperity,” according to a World Economic Forum statement. “It also highlights that monetary stimulus measures such as quantitative easing are not enough to sustain growth and must be accompanied by competitiveness reforms.” And in emerging economies, “updated business practices and investment in innovation are now as important as infrastructure, skills and efficient markets.”

It finds that “sub-Saharan Africa’s competitiveness has slightly weakened year on year, mainly as a consequence of deteriorating macroeconomic environments across the region.

“Public finance has been put under stress by economic slowdowns among trading partners and persistently low commodity prices, which affect the commodity-exporting countries. These factors help to explain why growth has dropped from over 5.0 percent two years ago to only 3.5 percent in 2015 and is projected to fall further, to 3.0 percent, in 2016.”

The region has however recorded improvements in the business environment, information and communication technologies, and infrastructure this year, but “these have been insufficient to improve overall productivity levels.” It main priorities are improving infrastructure, technological readiness, and health and primary education “as the region seeks to reap the demographic dividend by creating more employment opportunities for the millions of youth who will enter the labour market every year.”

The Global Competitiveness Report evaluates the strengths and weakness of 138 economies on twelve pillars. It further splits the pillars into several indicators; for example, the “Institutions” pillar measures the quality and strength of public institutions and private institutions. Public institutions are assigned a weight of 75%, and are further subdivided into property rights, ethics and corruption, undue influence, public-sector performance, and security. Its publisher, the World Economic Forum, says it “remains the most comprehensive assessment of national competitiveness worldwide.