Sub-Saharan Africa is base to a fast-growing tech start-up ecosystem that is playing an increasingly important role in the development of homegrown digital content and services, according to the 2018 Mobile Economy report by GSMA, the global association of mobile network operators.

The report shows that Sub-Saharan Africa accounted for $515m (Shs1.8 trillion) in more than 100 tech startup deals in 2017 out of the $560m (Shs2 trillion) raised on the continent.

“The range of tech startups funded and the growing size of deals reflect the accelerating development of the ecosystem,” GSMA said in the report. The report shows that Fintech (21%), solar (21%), e-commerce (19%) and edtech (12%) accounted for the highest shares of investment.

“This underscores the increasing innovation and investor interest in solutions that address the region’s starkest social challenges, such as limited access to financial services, education and energy by large swathes of the population.”

GSMA says mobile is a key factor in the region’s startup ecosystem with many tech startups now using the technology as the primary platform to create solutions that address various socioeconomic challenges.

It adds that mobile network assets and services such as APIs, IoT, mobile money and billing platforms, are enabling the implementation of sustainable business models for key services across verticals.

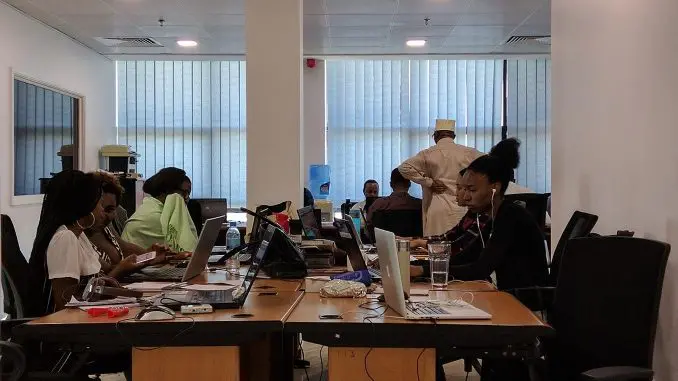

Research by the GSMA Ecosystem Accelerator programme found that there were 355 active tech hubs across Sub-Saharan Africa in 2018, up from 239 in 2016. Nearly half of all the tech hubs in the region are located in five countries – South Africa, Nigeria, Kenya, Ghana, and Uganda.

Others are in Cote d’Ivoire, Zimbabwe, and Senegal.

“Countries including Côte d’Ivoire, Guinea, Kenya, Mauritius, Rwanda, Tanzania and Uganda have done well in driving digital P2G payments, with the most popular use cases including tax collection, school fee payment and health services payment,” GSMA said.

In Kenya for example, GSMA said the central e-government platform (eCitizen) hosts more than 250 government services. More than 90% of digital payments in the country are via mobile money, while 85% of Nairobi City County payment wallet re-loads are also via mobile.

In Uganda in 2015, GSMA said, mobile technology provider Yo Uganda partnered with coffee exporter Kyagalanyi Coffee, United Nations Capital Development Fund and mobile operator MTN to digitise business-to-person payments to smallholder farmers in the coffee value chain.

As of January 2017, around 3,000 unique smallholder farmers supplying coffee cherries to Kyagalanyi had accepted mobile money as a mode of payment, the report said. This has helped reduce risks to personal safety for staff as well as the time wasted on the road travelling with physical cash.

Similarly, GSMA cited Ensibuuko which uses mobile money and the cloud to help SACCOs in Uganda mobilise and manage savings and to offer credit efficiently. Its customised software, MOBIS, enables SACCOs to gain better insights from their data, manage transactions, and make data-driven decisions.