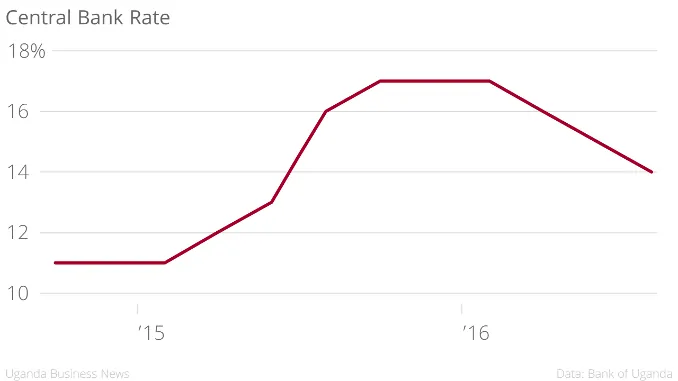

Bank of Uganda has cut its benchmark lending rate by 100 basis points to 14%, citing an improved near-term inflation outlook and the need to stimulate private sector credit growth. The cut is the third consecutive rate cut this year, following reductions in April and June.

Recent economic data showed a slowing economy, even as inflation was steadily declining towards the central bank’s target. One of the central bank’s main objectives is to ensure price stability, which means keeping inflation – specifically core inflation, which excludes volatile goods and services like food and energy prices – under control. Core inflation declined in the last two months, falling to 5.7% in July from 6.8% in June.

But whereas the central bank had projected that year-on-year core inflation would decline to its medium-term target of 5% in the first quarter of 2017, it has revised this prediction and now expects core inflation to have fallen to that level at the end of 2016, according to the Monetary Policy Statement released today.

This improved outlook, according to the central bank, is a “result of the recent stability of the exchange rate”; the shilling gained 0.90% against the dollar in July, after depreciating 0.30% in June.

Despite the fall in inflation and the shilling’s strength, other fundamentals were showing signs of weakness. High lending rates have been a concern over the past one year, leading to an increase in the ratio of nonperforming loans held by banks. As borrowing has become more expensive, business investment has been held back. This warranted easing monetary policy, according to Bank of Uganda.

The combination of improved business activity – that is if banks follow the central bank and lower lending rates – and increased government investment in infrastructure “are expected to support economic growth” in this financial year, the central bank said. This informs the bank’s growth estimate of 5.5% in 2016/2017 compared to 4.6% in 2015/2016.

Additionally, the central bank also said economic activity picked up in the final quarter of 2015/2016, compared to the third quarter when growth slowed. “The Bank of Uganda’s high frequency measure of of economic activity for July 2016 indicates a recovery in the fourth quarter of the financial year.”

The Rediscount rate and Bank rate were also each reduced by 100 basis points to 18 percent and 19 percent, respectively.