This article is adapted from a policy brief published by the International Growth Centre. Read the final report.

The level of interest rates and the cost of bank credit has been a topical issue in Uganda for many years. There have been widespread perceptions that lending interest rates are high, and that this is associated with exceptionally high spreads between bank lending and deposit rates.

This is a key issue, as Uganda has an ambitious development agenda in which the private sector should play a critical role, especially through investment in productive activities in manufacturing, mining, agriculture, tourism, housing, etc. Access to reasonably priced bank credit bank credit is important in facilitating the necessary investment, alongside other sources of finance.

Concerns about high bank interest rates and spreads have persisted, even as inflation has come down and the Bank of Uganda’s monetary policy regime has changed from a money targeting regime to an inflation targeting regime.

At the same time, the financial sector has developed, with new banks and nonbank financial institutions, which should, in principle, contribute to increased competition and financial sector efficiency.

From a policy perspective, addressing the problem of high spreads requires an understanding of the extent of the problem and its causes. Various possible explanations have been put forward; these include high levels of bank profitability; insufficient competition; high overhead costs; high levels of policy interest rates; or regulatory requirements.

Our research had three goals: to determine whether concerns about high spreads and bank lending rates in Uganda are justified; to determine the factors that determine interest rate spreads and the magnitude of their impact; and to identify potential policy levers that could help to address the level of bank interest rate spreads.

To address these questions, several different research methods were used.

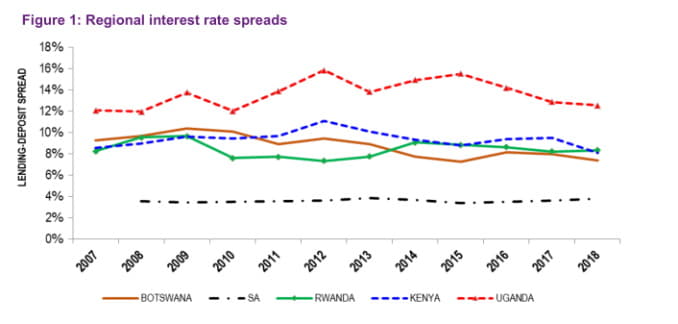

First, a comparative analysis was undertaken of banking sector indicators in six eastern and southern African countries — Uganda, Kenya, Rwanda, Zambia, Botswana and South Africa — to evaluate where Uganda stands in relation to interest rate spreads and other banking sector and policy variables.

Second, a detailed analysis was carried out on the Uganda banking sector whereby interest rate spreads were decomposed into the various bank-level drivers, such as overhead costs and profits.

Third, an econometric analysis was carried out of spreads using data on 20 individual banks over the period 2012 to 2018.

Key research findings

The different components of the research revealed broadly consistent findings:

- The regional comparative analysis confirmed that interest spreads in Uganda are relatively high, and have been consistently so from 2007 to 2018, which has been associated with high real lending rates.

- Ugandan banks are very highly capitalised, which in turn requires a high level of profitability to generate the return on capital that the shareholders require.

- It also found that official interest rates, in the form of real government bond rates, were the highest amongst the comparator countries. This influences the overall level of bank interest rates and gives banks an incentive to hold government debt rather than make risky loans.

The decomposition of interest rate spreads in Ugandan banks showed that the biggest contributor was overhead costs, which accounted for 61 per cent of spreads on average over 2008 to 2018, followed by loan loss provisions. The contribution of both factors has increased in recent years.

Other contributors, in order of importance, include the cost of holding statutory reserves, profits, and taxes.

The econometric analysis reinforced most of the above findings. It showed that overhead costs were a consistent determinant of spreads, with other variables including the level of market concentration, rate of economic growth, profitability, and real interest rates also having an influence.

Interestingly, foreign owned banks demonstrated lower interest rate spreads than domestically owned banks.

Policy recommendations

Several key policy implications flow from this analysis and results.

Firstly, a more competitive banking sector would help to reduce spreads. This does not necessarily mean more banks – Uganda already has a large number of banks given the size of the economy – but encouraging the growth of smaller or medium sized banks to challenge the dominant, large players.

Effective competition will also help to reduce bank profitability. This could be done through encouraging the consolidation of smaller banks by increasing minimum capital requirements.

A second policy implication is that operational or overhead costs – for staff, property, IT, infrastructure etc. – are a major contributor to spreads. This is in part due to duplication of infrastructure, and there would be merit in exploring ways in which infrastructure can be shared to benefit from economies of scale. There should also be a transition away from branch-based banking to electronic platforms.

The consolidation of smaller banks, to encourage competition through the creation of medium-sized banks, would also facilitate economies of scale and reduce the duplication of infrastructure across many small banks. The importance of overhead costs also suggests that there would be merit in examining whether regulatory requirements and legal processes add unnecessary costs.

Thirdly, a reduction in non-performing loans through better credit risk assessment should also narrow the gap between lending and deposit rates.

More work is needed to explain the high capitalisation rates of Ugandan banks, which leads to a high return on assets, which in turn leads to higher spreads. The Bank of Uganda could examine its method of evaluating the strength of banks, to see whether it inadvertently creates incentives for levels of capitalisation over and above that required to meet normal capital adequacy requirements.

Finally, reducing government borrowing could help to reduce spreads by leading to lower real government bond and treasury bill rates – and changing the incentive structure for banks to hold high-yielding government paper in favour of riskier assets.

Looking further ahead, there could be benefits in encouraging greater competition through regional banking integration, in line with the broader plans of the East African Community.

Full banking integration would allow banks licensed in one EAC member state to do business in another, based on a single banking license; such “passporting” is the basis of regional banking integration in the European Union.

While banks are licensed by their home regulator, there could be regionally agreed rules regarding the parameters for bank licensing (e.g., minimum capital requirements). This would be one way to quickly introduce more competition into the Ugandan banking sector and would also provide growth opportunities (elsewhere in the EAC) for Ugandan banks.