The Bank of Uganda maintained its key interest rate at a record low, noting that recent data points at a gradual yet subdued strengthening of economic activity and a favourable inflation outlook.

The central bank on Wednesday held its benchmark rate, the central bank rate, at 7 per cent, while the rediscount rate and the bank rate were maintained at 10 per cent and 11 per cent, respectively.

The CBR is the operating target of monetary policy and determines short-term interbank interest rates. The rediscount rate is the rate at which the Bank buys treasury bills and bonds from commercial banks, while the bank rate is that at which it lends to banks. The rediscount rate is based on the CBR and is set at a 3 percentage point margin over the policy rate, while the bank rate is set at 1 percentage point above the rediscount rate.

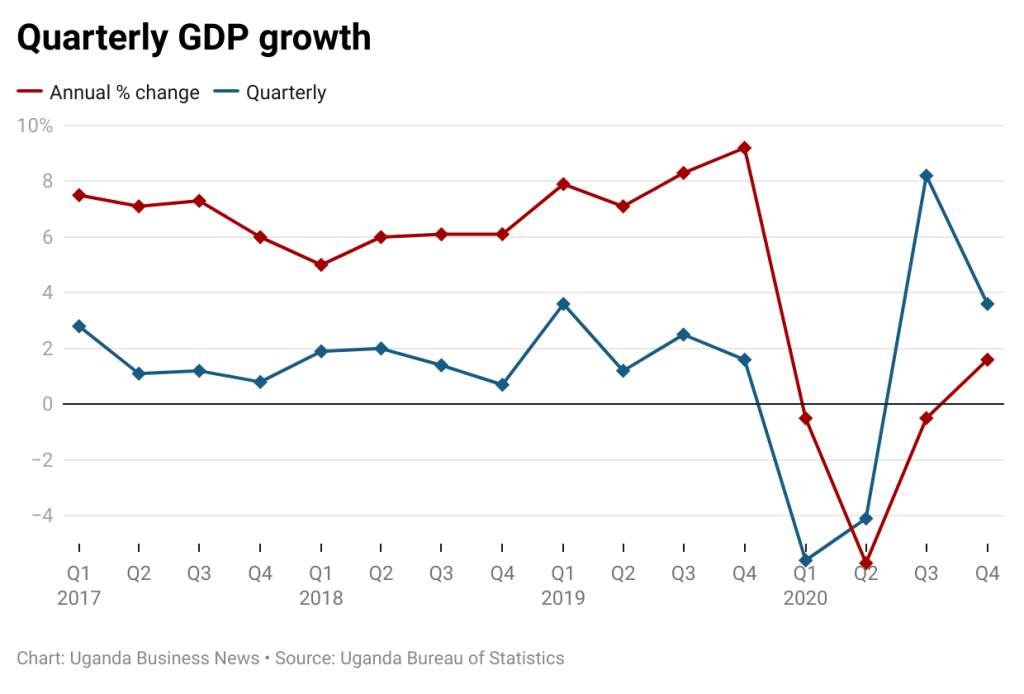

“The monetary policy committee noted that economic recovery is proceeding and is stronger than was projected at its last meeting in February 2021“, the Bank’s policy statement said. The latest quarterly growth figures from the Bureau of Statistics show that gross domestic product contracted by 1.2 per cent in 2020, lower than the central bank’s earlier projection of a 2 per cent decline.

In addition, growth in the last three months of 2020 came in at 1.6 per cent, reversing the declines recorded in the previous three quarters. The Bank however noted that certain activities in the service sector were still suffering the brunt of the Covid-19 pandemic, and that the sector had declined in the quarter.

“High frequency economic indicators for the first quarter of 2021 indicate a gradual strengthening of economic activity but still at a subdued pace,” the statement said. It added that GDP growth is expected to pick up in the next few years as “vaccine effectiveness increases”.

The BoU’s growth outlook was also unchanged: it forecast GDP growth of between 4 per cent and 4.5 per cent in the 2021/22 financial year.

The Bank said the balance of risks to its economic outlook are tilted to the downside, with the coronavirus the biggest threat as a rise in infections could dampen activity and delay a return to normalcy.

BoU also expressed concern about the rising levels of public debt, noting that they have led to “a limited fiscal policy space to respond to fragile economic growth.” Since a higher proportion of government revenue will go towards servicing the debt, “fiscal adjustments through higher taxes, lower expenditure or both might be required in the coming years to avoid a persistent increase in indebtedness, and this could constrain demand.”

The Bank added that government spending on public services, especially on infrastructure projects, could also be cut back due to limited resources, holding back investment, improvements in productivity levels and, ultimately, economic growth.

Inflation could also rise over the next few months due to a rise in the prices of food crops even as transport service prices fall. In addition, the “projected rise in some taxes combined with rising international oil prices, if the recent increase is sustained, may push up input price pressures across all sectors of the economy.”

Still, the central bank believes that the country’s economic output will remain below its potential level over the next year, resulting into downward pressures on inflation. It said that it expects average inflation of 5 per cent in the remaining months of 2021 and over the next few years.