A purported ‘contract farming’ company that was the subject of a warning from the Capital Markets Authority last month has reportedly vanished, according to social media reports, the latest in a series of similar scams.

Last month, the Capital Markets Authority issued a warning that it had not approved Capital Chicken Limited, The Mall Fund Limited and Veta Plan Chicken to “offer investment contracts to the public”. Now, according to reports on X (the former Twitter), Capital Chicken appears to have disappeared. The company’s phones were also switched off on Tuesday.

Capital Chicken, an ‘agribusiness contract farming partnership enterprise,’ claimed to engage in poultry farming for other parties, according to information on their website. They also engaged in ‘digital farming crowdfunding,’ better explained in their own words: “deploying deep learning and artificial intelligence in price data to help its investors identify the most profitable investment entries targeting high market demand for commodities invested with.” They also sold chickens.

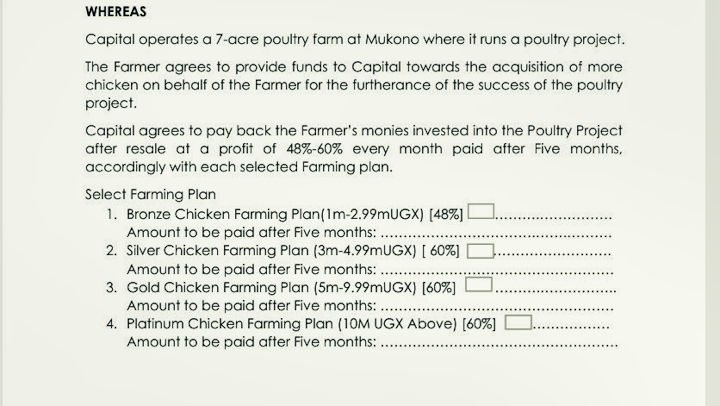

The company received money to apparently raise broiler chickens on a “seven-acre farm” and promised investors returns of between 48 per cent and 60 per cent, paid after five months. The returns were correlated to the amount invested, with a minimum threshold of Shs1 million, according to contract documents seen by this website.

The regulatory notice was a caveat emptor – Latin for let the buyer beware – warning the public that any dealings with the three companies were at their own risk. “It is important to note that in the absence of regulatory oversight, investors in unregulated investment activities have limited recourse in the event of unfair treatment, loss, or other challenge faced in their investment journey,” it said.

In its response to the CMA, Capital Chicken said it operated as a “farming partnership company, not an investment company”, despite indications to the contrary in its ‘Farming Partnership Agreement’. It touted its insurance cover with ‘Sanlaam’ – apparently for its poultry stock – and assured customers that their capital was “safe with us”.

“Temporary” closure

The company responded to reports of its closure on Tuesday evening, saying it was temporary and a result of the CMA notice. It added that the Financial Intelligence Authority, the government body responsible for combating money laundering and proliferation financing, had frozen its bank accounts in response to the notice.

(Capital Chicken’s ‘farming partnership agreement’ contains a detailed section outlining its position against money laundering. In section 5.1 it is stated that the company’s services do not aid money laundering and cannot be used for such purposes. Additionally, section 5.2 explains that the company’s anti-money laundering policy is included as an annex to the contract and that “investors” – that word, again – must comply with it.)

“We call upon our farming partners to be calm as we navigate the turbulence created by the various agencies who should have instead engaged us on regulatory issues if, indeed, the intention was to streamline our operations,” Capital Chicken said in a statement.

The company’s phones were still switched off on Tuesday evening.

An employee at Capital Chicken, who shared a WhatsApp status with “esteemed clients,” disclosed that the company’s offices were directed to shut down via a group text message on Thursday. The directive was issued by the organisation’s only director.