Lending to the private sector slowed in December due to a slackening in loans from microfinance deposit-taking institutions and stagnant growth in commercial bank loans.

According to central bank data, credit to the private sector rose 8.1 per cent year-on-year to Shs23.6 trillion, which is lower than the 8.6 per cent growth rate in the previous month.

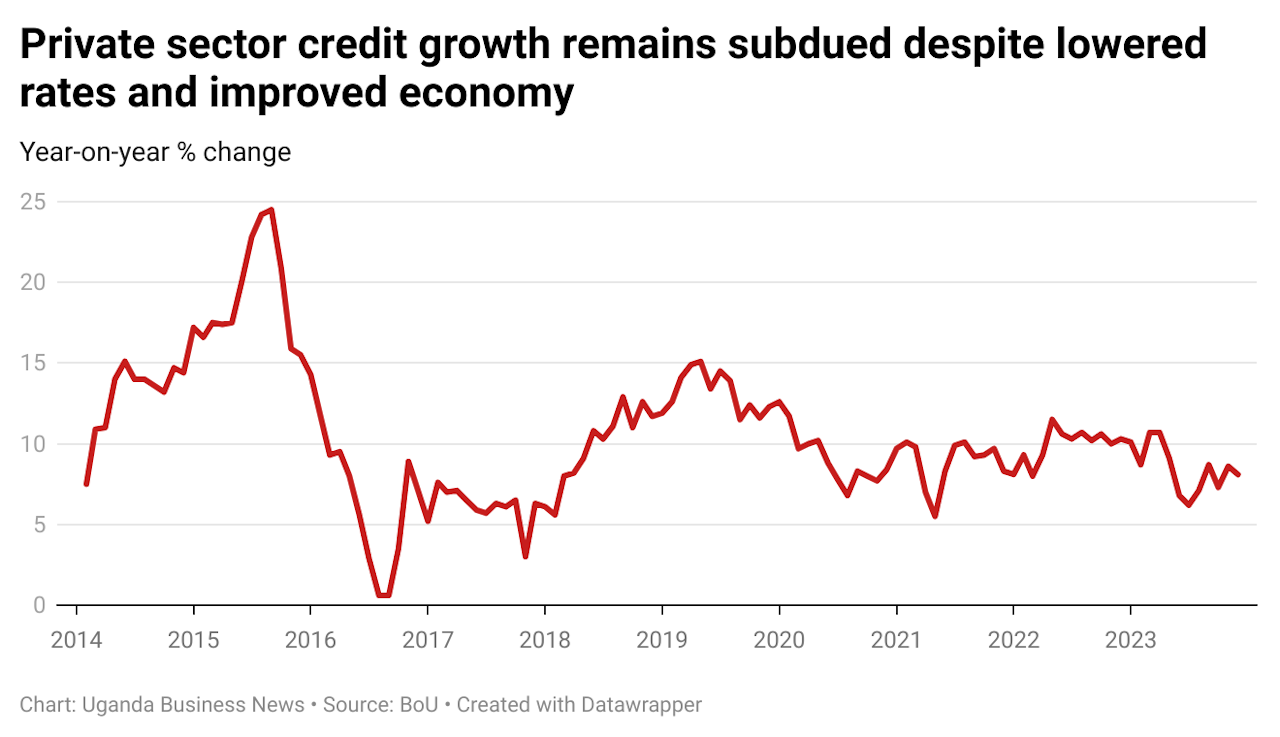

Private sector credit growth is one of the metrics monitored by the central bank to assess the impact of monetary policy, and is considered an indicator of the financial sector’s contribution to economic activity. Despite a decrease in interest rates over the past year, lending growth remains subdued and has stayed in single digits since last May.

Last August, BoU cut its policy rate from 10 to 9.5 per cent and has not raised it since. With the economy on a firmer footing than at the height of Covid-19, this should in theory have led to an increase in credit demand and lending.

The weak growth in loans to the private sector largely reflects tighter lending standards adopted by banks. In addition, banks have had to meet higher minimum capital requirements, which will take effect this June, requiring a reallocation of assets.

Average lending rates for shilling-denominated loans at banks fell to 16.7 per cent in December, the lowest in seven months. However, lending rates on foreign currency loans remained high, at least by historical standards, ranging from 8.1 per cent to 9.2 per cent between April and December.

Loans to the private sector grew by 8.1 per cent in the quarter to December, down from 8.7 per cent in the quarter to September. It was the second-weakest quarter for private sector credit growth in the last seven quarters, with only the second quarter of 2023 recording weaker growth.