The online financial products and services known as “fintech” have become deeply embedded in the economic and social life of many African countries over the past decade.

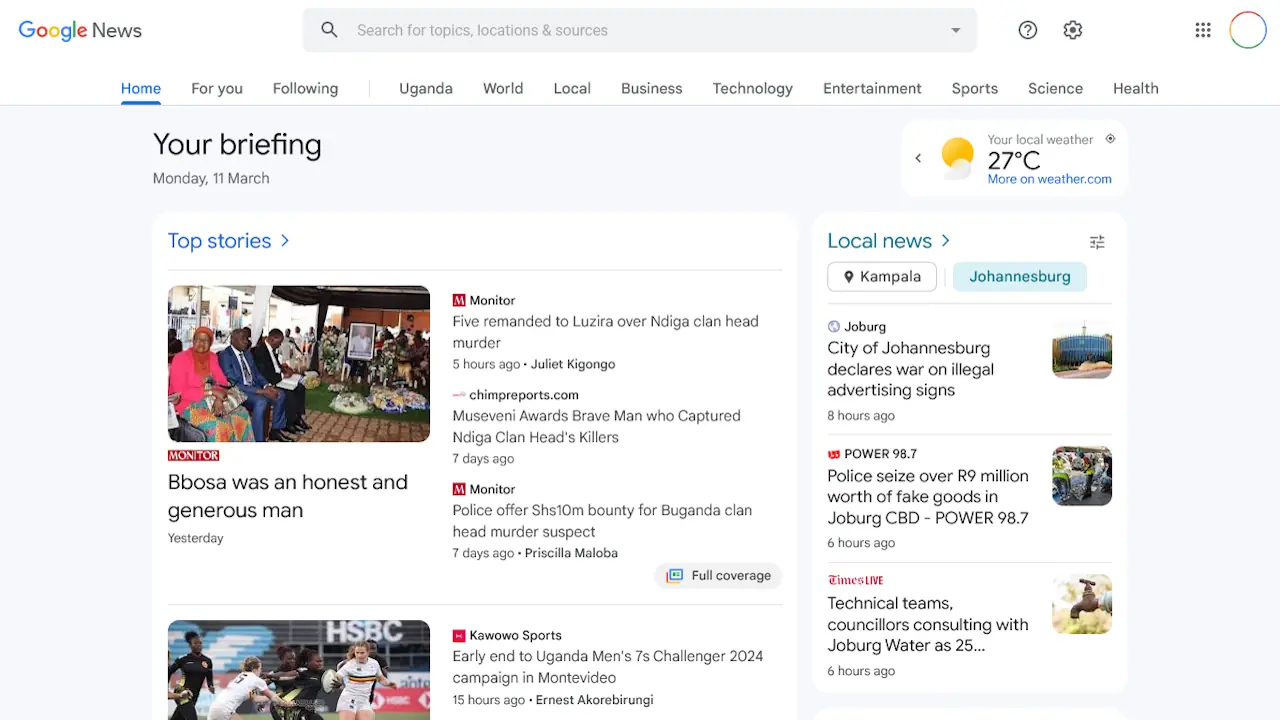

Headlines across the continent often extol fintech’s virtues. Technology is “driving financial inclusion” and “making life better for people”. It’s helping “consumers to manage inflation”. Fintech is “too sweeping to ignore”. And, if it’s not embraced, “the country and the entire economy will be left behind”.

These headlines depict a popular story about fintech: it is the answer to several of Africa’s economic problems. This story is also appearing in policy documents in countries like Uganda. Fintech is now a key component of the country’s National Financial Inclusion Strategy 2023-2028.

However, a counter-narrative is emerging. Political economists, anthropologists and social theorists warn that fintech is an example of an exploitative, neocolonial and racialised form of platform capitalism, a system by which a fairly small number of commercial networks profit from user activities and interactions. They caution that it is inherently anti-development. It is, they say, likely to cause a crisis of consumer debt, emotional distress, self-harm and data piracy.

We wanted to know how the press in Africa reports on fintech. Are its failings and potential pitfalls acknowledged? Is it mostly presented as a “good news” story?

So, in a project we began two years ago with South African political economist Scott Timcke, we set out to answer these questions. This kind of analysis helps reveal how public attitudes about this new pillar of everyday economic life are formed. It also shows whether the press is serving as the public’s watchdog with regard to economic matters and corporate affairs.

Our analysis, the first to look at how the fintech story is being told in the African press, reveals that the coverage is celebratory and offers limited cautionary and critical reporting to the public and to policymakers. We found that fintech is most often covered with a positive tone and as a business story.

The fintech context

International and African media coverage of the continent is often accused of fuelling negative stereotypes, a trend characterised as “afro-pessimism”. But in the past decade, much of the media conversation has focused on business buzz and followed an “afro-optimism” or “Africa rising” script, as the headlines above depict.

The fintech ecology is shaped by dynamics from the late 2000s. These include the rapid uptake in broadband use and the aftermath of the 2008 financial crash. Proponents claim that fintech will reduce poverty and motivate development (sometimes referred to as “leapfrogging” or “Silicon Savannah”), uplifting those unserved by formal banking. One 2016 study credited fintech with delivering a remarkable 2 per cent poverty reduction in Kenya.

Others call for a more cautious and sceptical approach. Critics dispute claims that fintech produces significant progressive change. They also argue that fintech can be exploitative and predatory, and that it fuels inequality by further enriching the already wealthy.

Our analysis

Previous research into the roll-out of fintech in countries across the continent revealed community-level tactics. “Change agents” are deployed to recruit new customers for mobile money services. “Brand ambassadors” are hired to “sit in public transport and talk about” fintech products.

We wondered whether journalists were similarly talking up fintech or were warning of its risks. We analysed news coverage and looked at journalism published between 2016 and 2021 by leading newspapers in Kenya, Uganda, and South Africa, as well as through the AllAfrica news aggregator. We began with a set of 1,190 news pieces and analysed a sample of 368.

Based on our initial examination of articles, we identified nine themes or frames that appeared frequently in news coverage of fintech.

The dominant frame was one we labelled “announcement”: the proclamation of a new fintech product through the media; a celebration of innovation. “Gender inclusivity” was the least common frame. This is the kind of reporting that focuses on a commonly shared rationale for fintech: that it particularly benefits women and gives them new opportunities for equality and participation.

We paid particular attention to the frame we called “trepidation”. We were surprised that 61 per cent of news stories within that frame had a positive overall tone, despite the frame implying potential danger. This trepidation often appeared as the backdrop for a news item rather than as the main story.

These kinds of stories, we reason, allow government officials to advise the public on safe financial conduct and fintech companies to promote the benefits of their “safe” products. The advice includes guidance on how individuals can enhance their awareness of potential risks, such as fraud, and act with caution. This consumer education approach is typical of anti-fraud measures across sectors.

Most stories about the hazards of fintech conclude that it is nonetheless a beneficial force and that any “hiccups” are minor. These can be soothed through state action (such as regulation) or individual responsibility (such as consumer education). Overall, this reinforces a narrative that it is safe and logical to embed fintech in society: it is “sanitised” through this style of news coverage.

Overall we concluded that the journalism in the African press we examined was largely sanitised. The tone, content and sourcing of reporting, even in the context of well-founded fears about fintech, point to an uncritical promotion of fintech products, firms and the entire industry.

More critical journalism needed

The breadth of fintech’s expansion across Africa and extent of potential harm it carries – even if its critics are only minimally correct – indicates a pressing need for further analysis of what story is being told. News audiences, politicians and civil society need to demand a more critical journalism.

Cathleen LeGrand, Postgraduate researcher, University of Leeds; Chris Paterson, Professor of Global Communication, University of Leeds, and Jörg Wiegratz, Lecturer in Political Economy of Global Development, University of Leeds

This article is republished from The Conversation under a Creative Commons licence. Read the original article.